Introduction

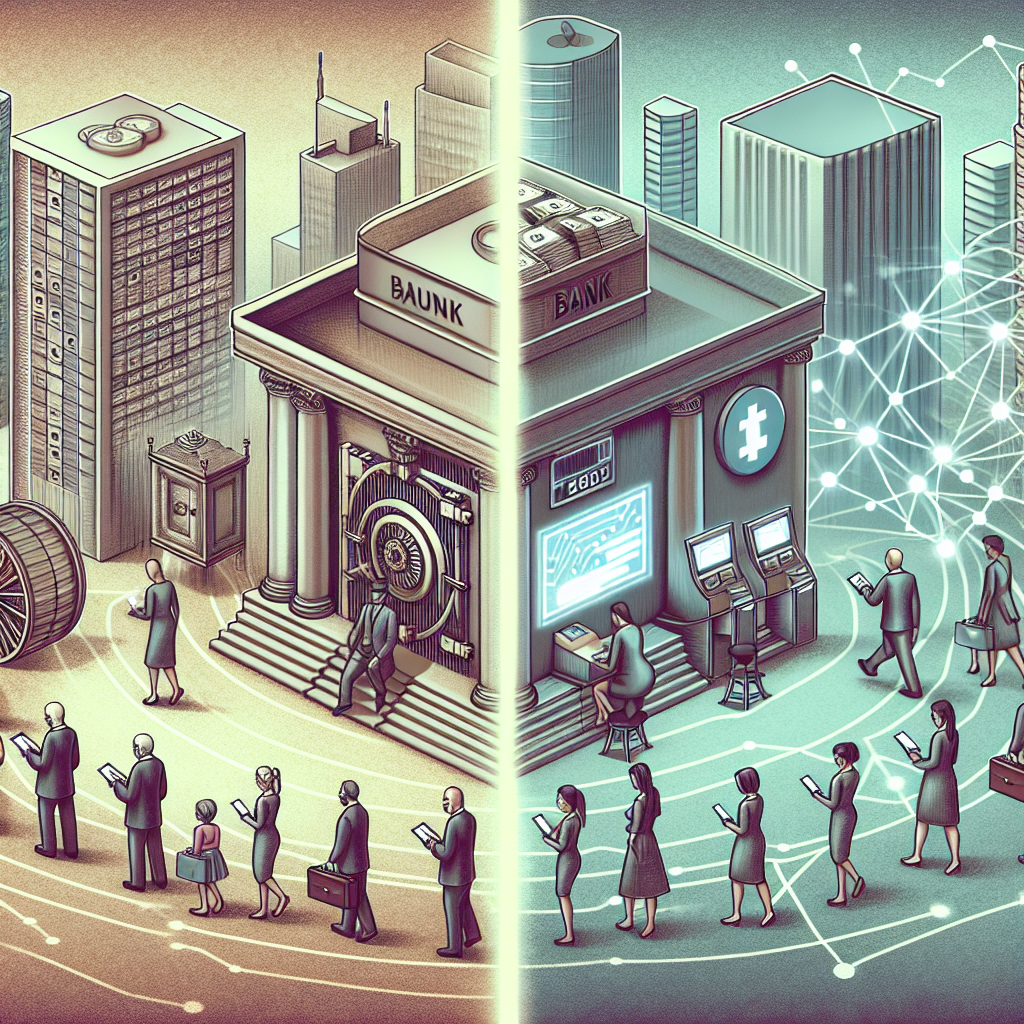

As consumer behaviors shift due to technological advancements and societal changes, payment institutions are at the forefront of adapting to these evolving demands. Understanding and responding to these shifts is critical for maintaining competitiveness in a rapidly changing market.

The Landscape of Consumer Demands

Increased Preference for Digital Payments

With the rise of e-commerce, digital wallets, and contactless payment options, consumers are increasingly opting for convenience and speed. Payment institutions are now navigating through a landscape where traditional payment methods are becoming less favorable.

Demand for Enhanced Security Features

Modern consumers are also more aware of security issues and demand robust protection measures. Institutions must implement multi-factor authentication, encryption, and other security protocols to gain user trust.

Personalization and User Experience

Consumers expect tailored experiences. Payment institutions are leveraging data analytics to offer personalized solutions, leading to enhanced customer satisfaction.

Technological Innovations Driving Change

Mobile Payment Solutions

Innovations in mobile payment applications have allowed users to make transactions seamlessly. Institutions are investing in improving these capabilities to meet consumer expectations.

Blockchain Technology

Blockchain is revolutionizing payment processing. Institutions are beginning to explore blockchain for faster and more secure transactions.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are being utilized to predict consumer behavior, detect fraud, and streamline payment processes, thereby enhancing overall efficiency.

How Payment Institutions are Adapting

Collaborations and Partnerships

Many institutions are forming partnerships with fintech companies to accelerate innovation and enhance service offerings.

Regulatory Compliance

Staying compliant with regulations is vital. Institutions are investing in compliance technologies to ensure they meet local and global standards.

Consumer Education

Many payment institutions have initiated consumer education programs to explain new technologies and related security measures.

Future Trends in Payment Processing

Open Banking

Consumers are gravitating towards open banking solutions, which allow them control over their financial data. Institutions are developing APIs to facilitate this trend.

Cryptocurrency Adoption

With increasing interest in cryptocurrencies, payment institutions are beginning to explore how to integrate these options into their platforms.

Frequently Asked Questions

Q: How can payment institutions improve customer trust?

A: By enhancing security features and providing transparent communication regarding any changes.

Q: What role does technology play in modern payment systems?

A: Technology facilitates quicker transactions, better security, and more personalized services.

Q: Are payment institutions prepared for future demands?

A: Many are actively investing in technology and partnerships to stay ahead of consumer trends.

Interview with a Payment Industry Expert

Interviewer: What do you think is the most critical factor in adapting to consumer demands?

Expert: The ability to be flexible and innovative is key. Consumer preferences change quickly, and being able to pivot can make or break an institution.

Conclusion

As consumer demands continue to evolve, payment institutions must remain agile and proactive. By leveraging technology and adopting a customer-centric approach, these institutions can ensure they meet the needs of their clients while maintaining a competitive edge.

Related Searches

- Digital payment trends 2023

- Consumer expectations in payment systems

- Future of payment processing

Citations:

- Payment Systems and Innovations: A Global Perspective [nofollow]

- Consumer Demand and Technological Influence in Fintech [nofollow]

#Adapting #Change #Payment #Institutions #Responding #Evolving #Consumer #Demands